Unlock your Equity to Buy Before You Sell

Apply in less

than 10 min

More Loan

Options

Fast pre-approval

you can count on

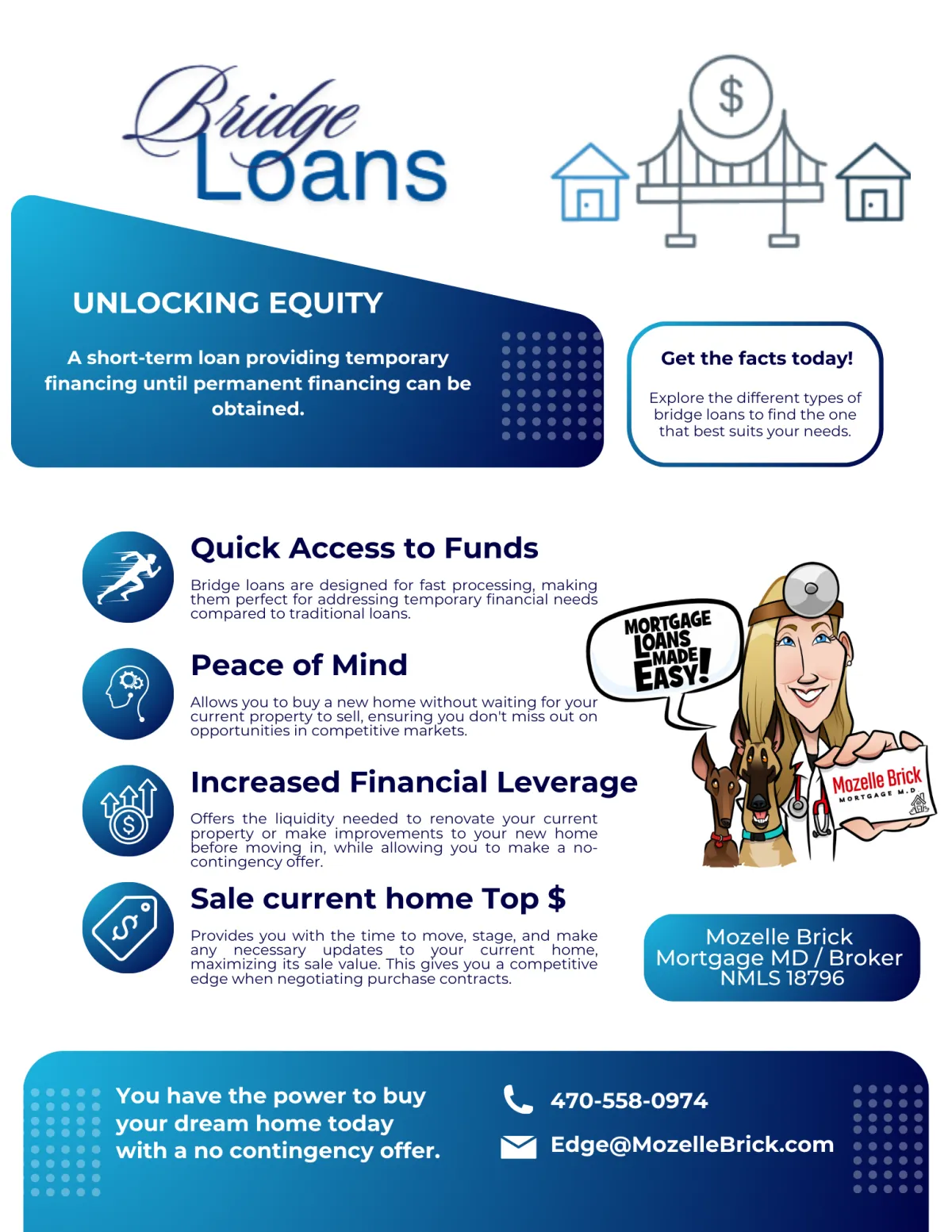

Understanding Bridge Loans:

What They Are & Why They’re Beneficial

Stop putting your dreams on hold—your new home might be closer than you think.

Let’s talk. I’ll take the time to explain everything clearly, based on your unique situation—no pressure, no obligation. Just real numbers, real answers, and a plan that makes sense for you.

My mission is to help 100 families this year, and if I can give you the clarity you need to move forward—or simply know where you stand—that’s one more family I’ve had the honor of helping.

Whenever you're ready, I'm here for you.

Achieve Your Dream of Homeownership with Edge Loan Advisor

A bridge loan is a short-term financing option that helps homeowners “bridge” the financial gap between buying a new home and selling their existing one. It provides quick access to funds, allowing buyers to move forward with a purchase before their current home sells.

If you’re in a competitive housing market or need immediate financing, a bridge loan can be a powerful tool to help you secure your next home without delays.

.

What is a Bridge Loan?

A bridge loan is a temporary loan that provides cash flow when transitioning from one home to another. It allows you to borrow against your current home’s equity to cover the down payment or purchase price of a new home. 💰 Loan Term: Typically 3-6 months (short-term financing)

🏠 Purpose: To help homeowners buy a new home before selling their existing home

📈 Interest Rates: Depending on the Bridge loan can range from zero % interest to Higher than traditional mortgages (due to short-term nature). This will depend on which lender you go to. Edge has a Conventional Bridge Loan investor that does not charge interest on their bridge loan. Contact me to discuss in more detail.

💡 Repayment: Paid off when the borrower sells their existing home or refinances into a new mortgage

How Does a Bridge Loan Work?

1️⃣ You take out a bridge loan using the equity in your current home.

2️⃣ Use the loan proceeds for a down payment or to cover the new home purchase.

3️⃣ Sell your current home and use the proceeds to pay off the bridge loan.

4️⃣ Once your old home is sold, you move into a traditional mortgage on the new home.

✅ Key Benefit: You can buy your new home before selling your old one, avoiding the hassle of moving twice or renting.

Benefits of a Bridge Loan

✅ 1. Helps You Secure a New Home Quickly

Allows you to purchase a new home before selling your current home. No need to rush into accepting a lower offer on your existing home.

✅ 2. No Contingency Offer Required

In competitive markets, sellers prefer offers without home sale contingencies. A bridge loan strengthens your offer since you don’t have to wait for your home to sell.

✅ 3. Provides Immediate Cash Flow for a Down Payment

If your equity is tied up in your current home, a bridge loan gives you fast access to funds. No need to wait for your home sale to free up cash for a down payment.

✅ 4. Short-Term Loan with Flexible Repayment

Bridge loans typically last 3-6 months, providing breathing room to sell your home. You can pay it off anytime without waiting for a lengthy loan term.

✅ 5. Avoids Moving Twice or Renting

If you sell your current home first, you may need temporary housing before buying a new home. A bridge loan lets you move directly into your new home, avoiding extra moving costs.

Potential Downsides of a Bridge Loan

❌ 1. Possible Higher Interest Rates

Since bridge loans are short-term and riskier, depending on the lenders the interest rates can be higher than traditional mortgages.

❌ 2. Requires Strong Credit & Equity

Most lenders require good credit (680+ recommended) and at least 20% equity in your current home.

❌ 3. Closing Costs & Fees

Bridge loans often come with Convivence fee of 2.4%, possible closing cost depending on the time it takes to sell your home, as well as an inspection fee on your exiting home.

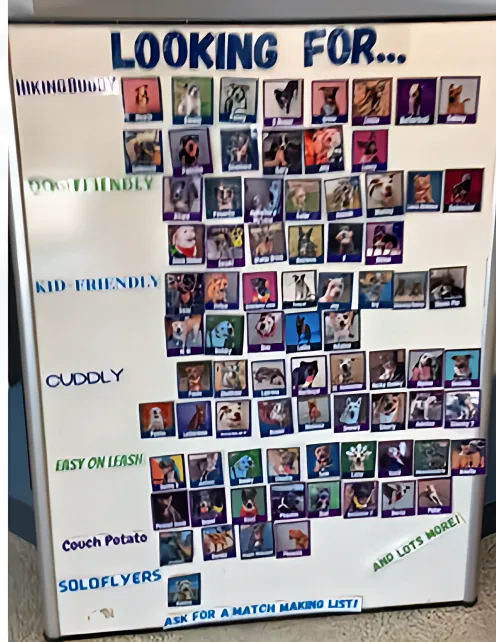

Who Should Consider a Bridge Loan?

🏡 You’re buying in a competitive market and need a stronger offer.

💰 Your equity is tied up in your current home, and you need cash for a down payment.

⏳ You want to avoid moving twice or renting before buying your new home.

🚀 You’re confident your home will sell quickly, allowing you to pay off the bridge loan fast.

💡 A bridge loan is ideal for buyers who need temporary financing and are confident they can sell their home within a few months.

Alternatives to a Bridge Loan

If a bridge loan isn’t the right fit, consider these alternatives:

🔹 Home Equity Loan or HELOC – Use your home’s equity for a lower-interest loan, but only if you have time to secure financing.

🔹 Contingency Offer – If the market allows, make an offer contingent on selling your current home.

🔹 Personal Loan or 401(k) Loan – May work for short-term financing, but check tax implications first.

Why Work With Me for a Bridge Loan?

Bridge loans aren’t right for everyone, but I can help you determine if one makes sense for your situation.

✔ With access to over 150+ investors, I have Bridge loans that allow for ZERO interest which can save you thousands of dollars.

✔ I’ll compare bridge loan options with alternative financing solutions.

✔ I’ll help you estimate costs and break down the numbers.

✔ I’ll guide you through the entire process so you’re never caught off guard.

💡 The right financing strategy can save you time, money, and stress. Let’s explore your options together!

Next Steps: Find Out If a Bridge Loan is Right for You

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

Get Started Today

With access to 150+ investors, we customize financing to fit your unique needs—whether you're buying, refinancing, or investing.

Your dream home is within reach!

Don't get stuck in your current home when your DREAM HOME

is just a conversation away.

Faster, Smoother Closings

Edge Home Finance Corporation © 2024. All Rights Reserved. NMLS #18796 Company NMLS #891464

Licensed In: AL, AR, CA, GA, FL, OH, TN

Edge Licensed 48 states Iwww.nmlsconsumeraccess.org