The Facts About Reverse Mortgages

More Loan

Options

Fast pre-approval

you can count on

One of the Most Protected Loan Available for Seniors

The Facts About Reverse Mortgages:

What You Need to Know

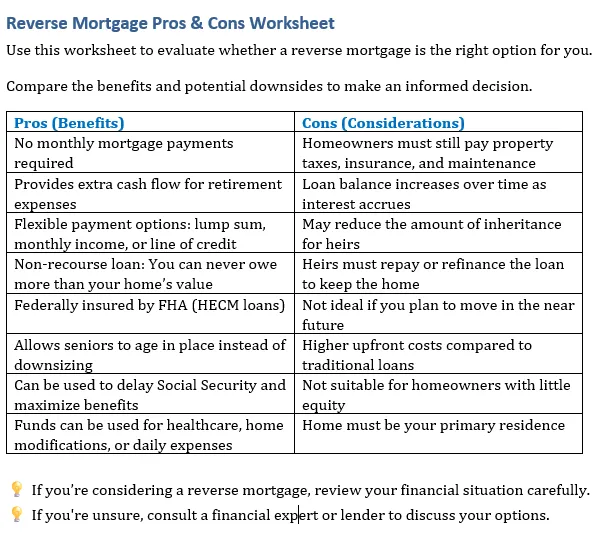

A reverse mortgage is one of the most misunderstood loan options, yet for the right person, it can be a powerful financial tool. While it may not be suitable for everyone, for those who qualify, a reverse mortgage can provide financial freedom, eliminate monthly mortgage payments, and supplement retirement income.

.

What is a Reverse Mortgage?

A reverse mortgage is a home loan designed for homeowners aged 62 and older that allows them to convert home equity into cash while continuing to live in their home without making monthly mortgage payments.

🔹 Loan Type: Home Equity Conversion Mortgage (HECM), insured by the FHA

🔹 Who Qualifies? Homeowners 62 years or older who have sufficient home equity

🔹 Repayment: The loan is repaid when the borrower sells the home, moves out permanently, or passes away

🔹 Use of Funds: Borrowers can receive cash, a line of credit, or monthly payments

💡Think of it as a way to turn your home into a retirement asset—without selling it.

Why Reverse Mortgages Are a Great Loan Option

✅ 1. No Monthly Mortgage Payments Required

Borrowers do not have to make mortgage payments (they still must pay property taxes, homeowners insurance, and maintenance). This frees up cash flow for everyday expenses, medical costs, or travel.

✅ 2. You Can Receive the Funds in Multiple Ways

a. Lump Sum – Receive a large payout upfront.

b. Monthly Payments – Get a steady stream of income.

c. Line of Credit – Access funds when needed, with the remaining balance growing over time.

✅ 3. Retain Home Ownership

a. Many believe they lose ownership of their home, but that’s a myth.

b. Homeowners continue to live in their home as long as property taxes, insurance, and upkeep are maintained.

✅ 4. Federally Insured & Safe

FHA-insured HECM loans provide protections, ensuring borrowers NEVER owe more than their home’s value.

✅ 5. Helps Seniors Age in Place

a. Provides extra income without selling the home.

b.Helps cover in-home care, medical expenses, or home modifications for aging homeowners.

Why Reverse Mortgages Are Misunderstood

Despite the many benefits, reverse mortgages are often misunderstood due to myths and misinformation. Let’s clear up some of the most common misconceptions:

❌ Myth 1: The Bank Takes Your Home

✅ Truth: You retain full home ownership—the lender does not take the title. The home remains in your name, and your heirs can sell, refinance, or keep the home after you pass.

❌ Myth 2: You Can Owe More Than Your Home is Worth

✅ Truth: Reverse mortgages are non-recourse loans, meaning you can NEVER owe more than the home’s value. If the home sells for less than the loan balance, FHA insurance covers the difference.

❌ Myth 3: Reverse Mortgages Are Only for Financially Struggling Seniors

✅ Truth: While a reverse mortgage can help those in need, it’s also a smart financial tool for wealthier homeowners who want to protect investments, avoid drawing from retirement funds, or increase liquidity.

❌ Myth 4: Family Members Lose Inheritance

✅ Truth: Heirs still inherit the home and can choose to sell, refinance, or keep the property. If they sell, any remaining home equity belongs to them.

❌ Myth 5: Reverse Mortgages Are a Last Resort

✅ Truth: Many financial planners recommend reverse mortgages as part of a retirement strategy, not just a last resort. They help preserve savings, delay Social Security withdrawals, and increase financial flexibility.

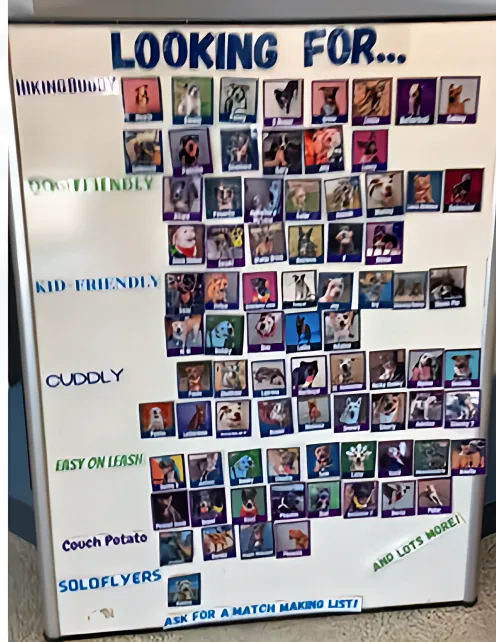

Who is a Reverse Mortgage a Good Fit For?

Reverse mortgages aren’t for everyone, but for the right person, they are an excellent financial tool. You may be a good candidate if you:

✔ Are 62 or older and want to eliminate monthly mortgage payments.

✔ Have significant home equity and want to turn it into cash.

✔ Plan to stay in your home long-term and want to age in place.

✔ Want a safety net for unexpected expenses or medical costs.

✔ Prefer to keep your retirement accounts intact rather than withdrawing funds.

💡 For seniors looking to enjoy financial freedom without selling their home, a reverse mortgage can be life-changing.

Who Should Think Twice About a Reverse Mortgage?

A reverse mortgage may not be the right fit if:

❌ You plan to move soon. Moving out means the loan must be repaid, making it impractical.

❌ You can’t afford taxes and maintenance. Borrowers must still pay property taxes, insurance, and home upkeep to avoid default.

❌ You want to leave a fully paid-off home to heirs. If heirs prefer to inherit a debt-free home, they would need to pay off or refinance the loan.

❌ You don’t have enough equity. Lenders require a minimum level of home equity to qualify.

💡 If you plan to downsize, move into assisted living, or leave a debt-free home to heirs, other financial strategies might be better.

Alternative Options to Consider

If a reverse mortgage isn’t the right fit, consider:

🔹 Home Equity Line of Credit (HELOC) – A flexible borrowing option, but requires monthly payments.

🔹 Downsizing to a Smaller Home – Sell your home and move into a lower-cost property.

🔹 Cash-Out Refinance – Access home equity while keeping a traditional mortgage structure.

🔹 Selling & Renting – Convert your home’s equity into cash while eliminating ownership responsibilities.

Why Work With Me to Explore a Reverse Mortgage?

Reverse mortgages can be confusing—and they're often misunderstood, even by other professionals. That’s why I’ve made it my mission to not only guide homeowners like you, but also to teach other lenders and financial advisors about how these loans truly work. When you work with me, you're getting the benefit of years of experience, a deep understanding of the product, and a commitment to making sure you feel informed, comfortable, and confident every step of the way.

✔ I provide a clear, honest breakdown of costs, benefits, and risks.

✔ I compare all financial options so you can make an informed choice.

✔ I ensure full transparency so you understand every detail of your loan.

✔ I work for YOU, not the lender—so you’ll only move forward if it’s truly the best fit for you.

💡 A reverse mortgage isn’t for everyone, but if it’s right for you, it can be an incredible tool for financial freedom. Let’s explore your options together!

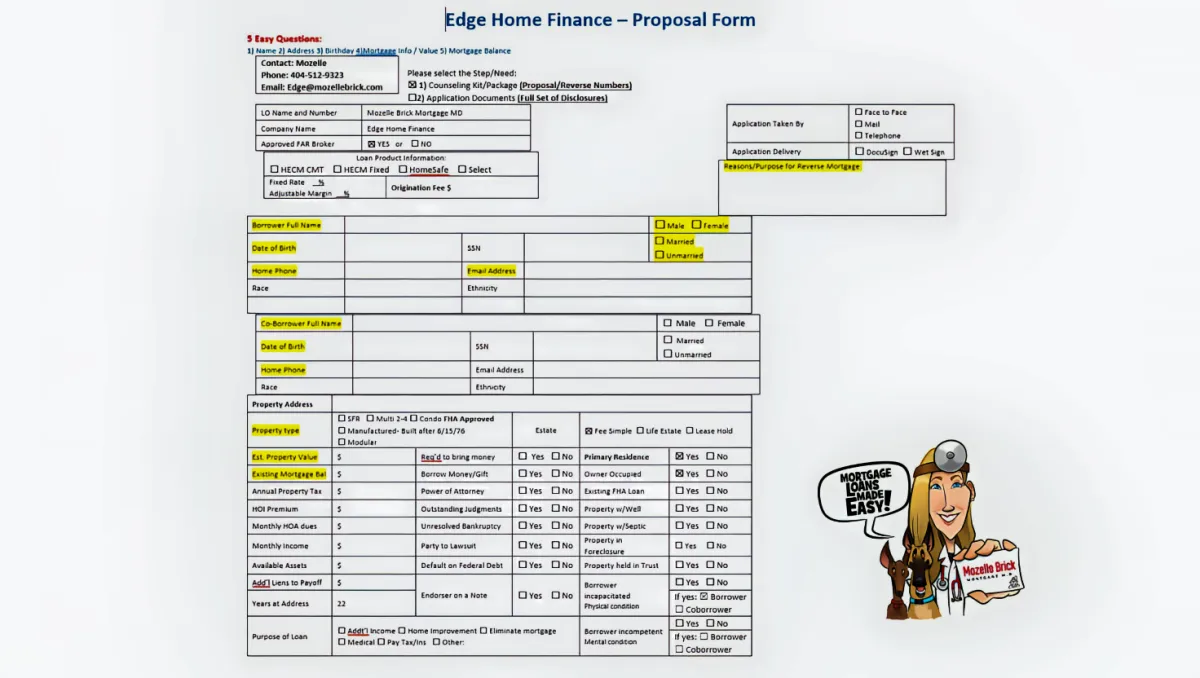

Next Steps: Get a Free Reverse Mortgage Review

Let’s review your situation together! 📞 Contact me today for a no-obligation consultation!

Not sure if a reverse mortgage is right for you?

With access to 150+ investors, we customize financing to fit your unique needs—whether you're buying, refinancing, or investing.

Free Proposal "CREDIT NOT PULLED"

- Only need 5 things

Your Name

Birthday

Address

Mortgage info / Value

Mortgage Balances

Faster, Smoother Closings

Edge Home Finance Corporation © 2024. All Rights Reserved. NMLS #18796 Company NMLS #891464

Licensed In: AL, AR, CA, GA, FL, OH, TN

Edge Licensed 48 states Iwww.nmlsconsumeraccess.org