Better Protections for Reverse Mortgages

More Loan

Options

Fast pre-approval

you can count on

One of the Most Protected Loan Available for Seniors

Positive Changes in Reverse Mortgages

Reverse Mortgage Law Changes & Their Impact

(2005 - Present)

Here is a list of key law changes and regulations that have strengthened reverse mortgages (Home Equity Conversion Mortgages - HECMs) since 2005, making them one of the most protected loan options available to senior homeowners. These changes have increased borrower protections, reduced risks, and added safeguards to ensure reverse mortgages remain a safe and sustainable financial tool.

.

Why Reverse Mortgages Are Now One of the

Most Protected Loans Available

Over the past two decades, laws and regulations have transformed reverse mortgages into a safe, regulated, and consumer-friendly loan option.

Key Protections for Borrowers Today:

✅ Mandatory Financial Assessment – Prevents borrowers from defaulting on taxes & insurance.

✅ Non-Borrowing Spouse Protections – Spouses are no longer forced to leave if the borrower passes away.

✅ Withdraw Limits & Safeguards – Prevents quick equity depletion, ensuring long-term financial stability.

✅ Government-Backed Insurance (FHA) – Ensures borrowers never owe more than their home’s value.

✅ Strict Counseling Requirements – Borrowers must complete HUD-approved counseling before securing a loan.

💡 These changes ensure that reverse mortgages are safer and better suited for long-term financial security!

🔹 2021-Present: Ongoing FHA & HUD Oversight Enhancements

📜 What Changed?

🔹FHA continues to monitor & adjust HECM regulations to protect borrowers.

🔹Introduced more detailed counseling requirements to ensure borrowers fully understand the loan.

🔹Improved HECM-to-HECM refinancing rules to prevent unnecessary refinancing and equity stripping.

✅ Impact:

🔹Enhanced borrower education to prevent financial misunderstandings.

🔹Strengthened oversight against predatory lending practices.

🔹 2018: More Protections for Borrowers & Non-Borrowing Spouses

📜 What Changed?

🔹Expanded protections for non-borrowing spouses, ensuring they could stay in the home indefinitely if they met loan terms.

🔹Refined financial assessment requirements to ensure long-term affordability.

✅ Impact:

🔹Strengthened protections for surviving spouses.

🔹Reduced the risk of foreclosure due to unpaid property obligations.

🔹 2017: New Mortgage Insurance Premium (MIP) Structure

📜 What Changed?

🔹Upfront MIP standardized at 2% of the home's value for all borrowers.

🔹Annual MIP reduced from 1.25% to 0.5%, lowering long-term costs.

✅ Impact:

🔹Made reverse mortgages more affordable by reducing yearly insurance costs. Protected taxpayers & FHA reserves by ensuring loan sustainability.

🔹 2015: New Rules for Withdrawals & Principal Limits

📜 What Changed?

🔹Capped the amount borrowers could withdraw in the first year (typically 60%) to prevent misuse.

🔹 Adjusted loan-to-value ratios based on borrower’s age & interest rates to improve financial sustainability.

✅ Impact:

🔹Prevented quick depletion of home equity, ensuring the loan lasts longer.

🔹Made the program financially stable for both borrowers and the FHA.

🔹 2014: Non-Borrowing Spouse Protection Rule

📜 What Changed?

🔹Allowed non-borrowing spouses (spouses not listed on the loan) to remain in the home after the borrower passes away.

🔹Protected spouses from being forced to sell or move after the primary borrower dies.

✅ Impact:

🔹Increased security for surviving spouses who previously had no legal right to stay in the home.

🔹 2013: Reverse Mortgage Stabilization Act

📜 What Changed?

🔹Introduced the Financial Assessment Rule: Borrowers must prove they can afford property taxes, homeowners insurance, and maintenance.

🔹Limited lump sum withdrawals to ensure longevity of funds.

🔹Created a set-aside fund to cover taxes & insurance if needed.

✅ Impact:

🔹Reduced defaults & foreclosures by ensuring borrowers can maintain their home.

🔹Made reverse mortgages more financially stable for long-term use.

🔹 2008: Housing and Economic Recovery Act (HERA)

📜 What Changed?

🔹Established the HECM for Purchase program, allowing seniors to use a reverse mortgage to buy a home.

🔹Limited lender fees to prevent excessive origination charges.

🔹Strengthened HUD oversight of the reverse mortgage industry.

✅ Impact:

🔹Expanded the use of reverse mortgages beyond refinancing.

🔹Prevented lenders from overcharging seniors with unnecessary fees.

🔹 How These Changes Improved Reverse Mortgages

Between 1990 and 2005, significant regulatory changes made reverse mortgages safer and more accessible for seniors. Key protections include:

✅ FHA insurance ensuring borrowers never owe more than their home’s value.

✅ Mandatory independent counseling to prevent financial abuse.

✅ Caps on fees and lender charges to protect borrowers from excessive costs.

✅ Expansion of loan options, including adjustable rates and flexible payouts.

💡 These reforms laid the foundation for reverse mortgages as one of the most secure financial products available for retirees today.

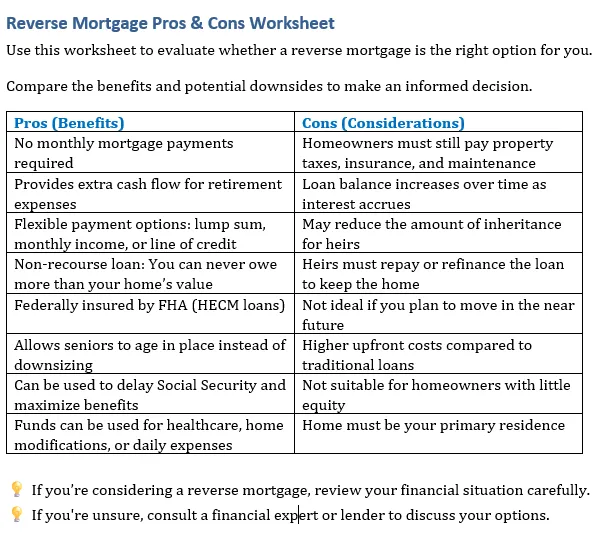

Is a Reverse Mortgage Right for You?

If you’re considering a reverse mortgage, let’s review your options together! 📞 Contact me today for a FREE personalized consultation on reverse mortgages! (470)558-0974

💡 I work for YOU, not the lender— so you’ll only move forward if it’s truly the best fit for you.

Next Steps: Get a Free Reverse Mortgage Review

Get Real numbers today!

With access to 150+ investors, we customize financing to fit your unique needs—whether you're buying, refinancing, or investing.

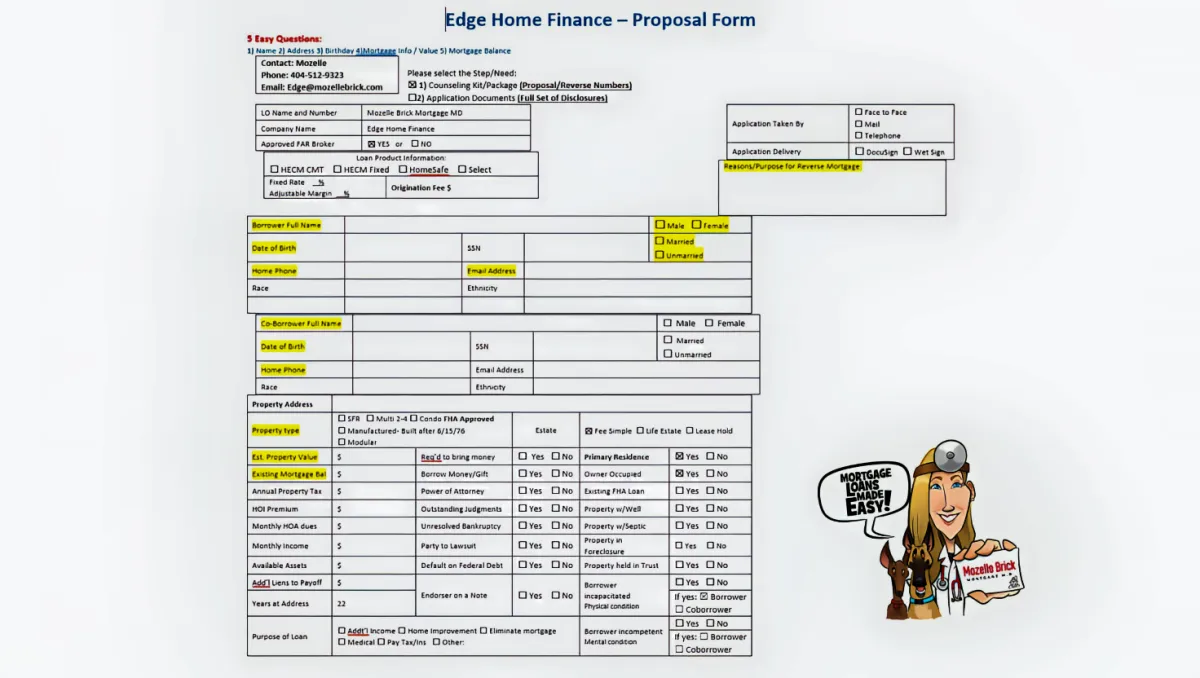

Get your FREE proposal Today - Only need 5 things

"Credit and Application not needed for proposal"

Your Name

Birthday

Address

Mortgage info / Value

Mortgage Balances

Faster, Smoother Closings

Edge Home Finance Corporation © 2024. All Rights Reserved. NMLS #18796 Company NMLS #891464

Licensed In: AL, AR, CA, GA, FL, OH, TN

Edge Licensed 48 states Iwww.nmlsconsumeraccess.org